what is disposal of asset under the real property gains tax act 1976

Amendment of Section 21B which states. A uk resident company is subject to corporation tax at 19 reducing to 17 from 1 april 2020 on gains realised on the disposal of commercial property.

Wills Trusts Estates Prof Blog

Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property.

. An allowable loss means a loss suffered on the. 1 Where an asset is an asset of a trust or partnership then in whatever persons the ownership of the asset is vested any acquisition or disposal of the asset shall be treated as an acquisition. It is imposed on gains.

1 A tax to be called real property gains tax shall be charged in accordance with this Act in respect of chargeable gain accruing on the disposal of any real. Capital gains tax is a tax on the growth in the value of an investment and is levied when the investment is sold. Where a chargeable asset is disposed of and the disposal price is less than the acquisition price there is an allowable loss.

If the company or any of its agents withholds from any distribution any amount on account of taxes or governmental charges or pays any other tax in respect of such distribution ie stamp. RPGT is a tax imposed on the gains derived from the disposal of real property. DISPOSAL OF ASSET UNDER THE REAL PROPERTY GAINS TAX ACT 1976 Sheet.

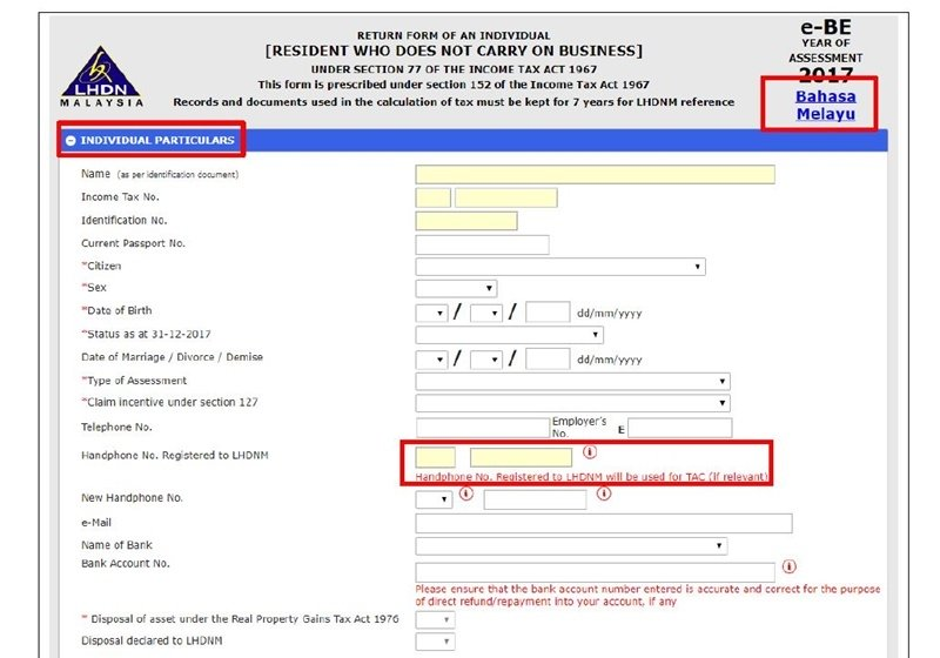

As you scroll down the page you will see an item called Disposal of asset under the Real Property Gains Tax Act 1976 which refers to any disposal of assets under the Real Property. A disposal is deemed to have occurred when a person holding a real property as an asset transfers it to trading inventory of the person paragraph 17A Schedule 2. These amendments come into force on 1 January 2022.

The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble. The Real Property Gains Tax Act 1976 RPGT Act expressly states that it is the trustee of a trust that is assessable and chargeable with tax. The disposer is devided into 3 parts of categories as per.

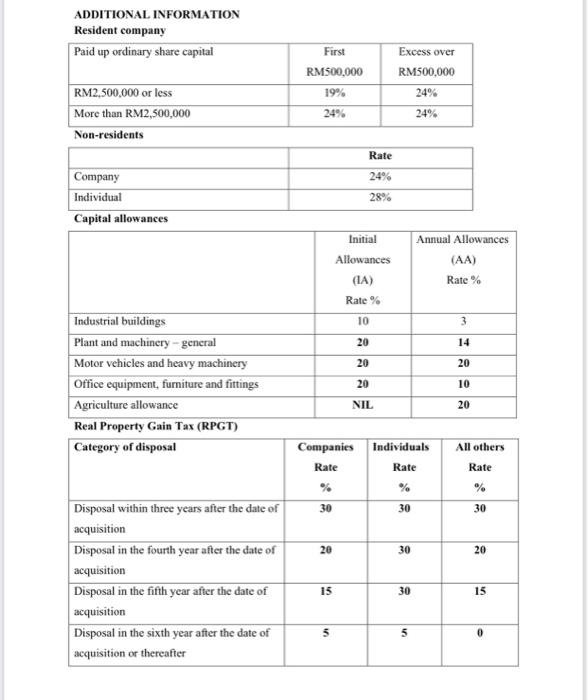

The types of property that are subject to a personal property tax varies by each state and municipality that has its own property tax rate. A chargeable gain is a profit when the disposal price is. Real Property Gains Tax RPGT Rates RPGT rates differs according to disposer categories and holding period of chargeable asset.

A The Real Property Gain Tax RPGT Act 1976 specify number of circumstances where the disposal price of a chargeable asset is deemed to be equal to its. This part Regulation Y is issued by the Board of Governors of the Federal Reserve System Board under section 5b of the Bank Holding Company Act of 1956 as amended 12. Disposal of a Property or Asset Disposal is the transfer of ownership from one person to another through settlement sale conveyance alienation or assignment.

The gain is payable when the resale. The chargeable gain is usually the difference between the price. Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC.

The net effect is that there will be RPGT imposed on all sellers for disposal of any real properties in Malaysia. Real property is defined as any. 1 A tax to be called real property gains tax shall be charged in accordance with this Act in respect of chargeable gain accruing on the disposal of any real.

Essentially RGPT is a tax levied on chargeable gains from the disposal of chargeable assets such as houses commercial buildings farms and vacant lands. Taxation of chargeable gains. You can defer tax liability if you sell the.

With effect from 21101988 RPGT is extended to gain from disposal of shares in real property company RPC ASSET includes any land situated in Malaysia and any interest option or. The Real Property Gains Tax RPGT is a tax on profit from selling all chargeable assets such as houses commercial buildings farms and vacant land. Amendments and additions to the Real Property Gains Tax Act 1976.

Taxation of chargeable gains 3. Asset or 2 for No if not applicable. In fact any disposal of an asset.

However in order to.

Latest Amendments In Real Property Gains Tax Iqi Global

Malaysia Personal Income Tax Guide 2020 Ya 2019

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Rpgt Publication By Hhq Law Firm In Kl Malaysia

Capital Gains Tax In The United States Wikipedia

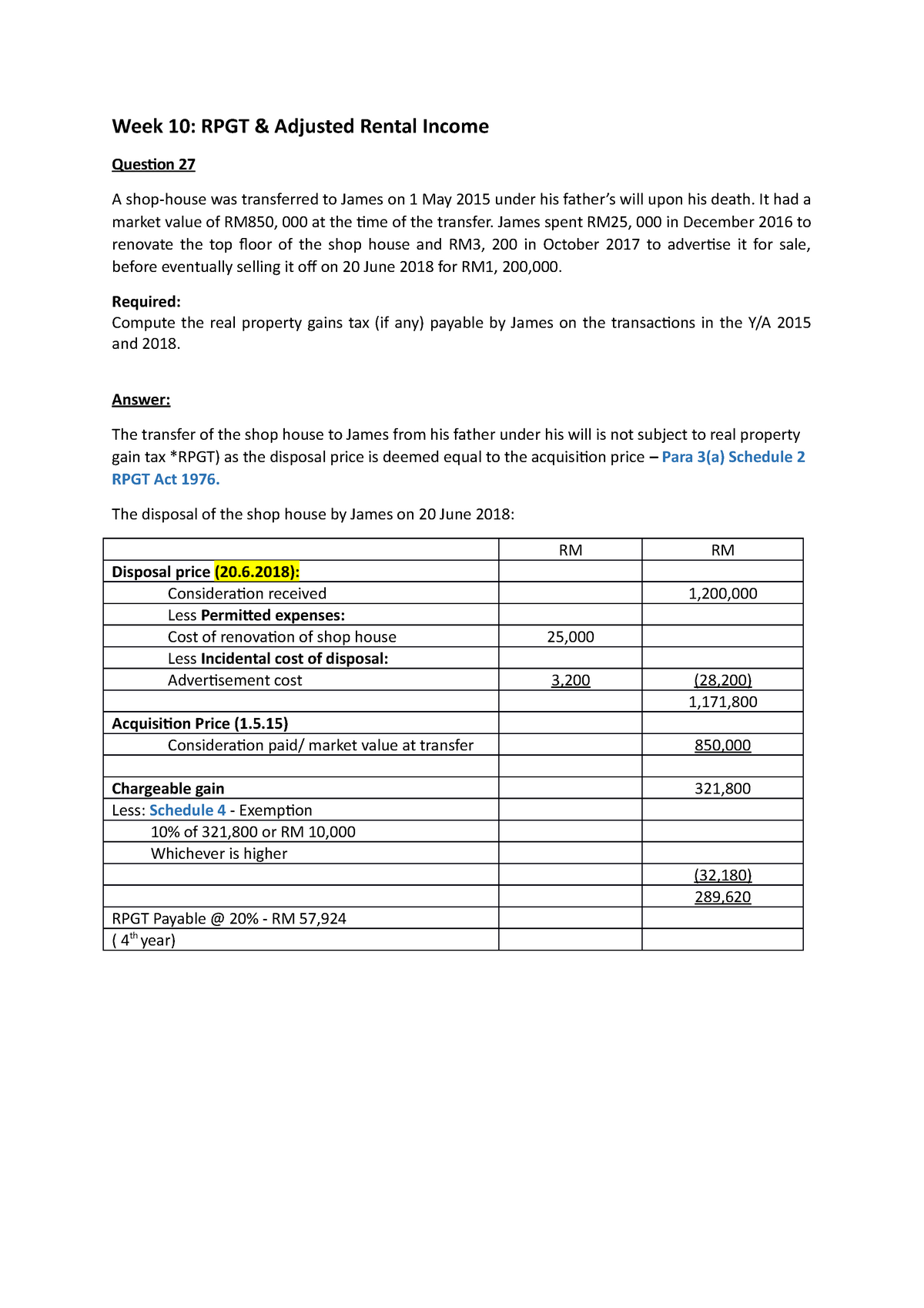

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

Capital Gains Tax In The United States Wikipedia

Highlights Of The Tax Law Signed By President Carter The New York Times

Taxability Of Reit Under The Real Property Gains Tax Act 1976 Lexology

Capital Vs Revenue Crowe Malaysia Plt

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

The Finance Act 2021 Key Changes To The Real Property Gains Tax Act 1976 Richard Wee Chambers S News

Did You Know That You Need To Pay Real Property Gains Tax If You Made A Profit From Sale Of Your Property Case Facts By Hhq Law Firm In

Solved Question 3 25 Marks A Rpgt Is A Tax On Capital Chegg Com

How To Calculate Rpgt In 2020 For Sale Of An Inherited Property

Malaysia Real Property Gains Tax Guide Paul Hype Page

Key Changes In The Real Property Gain Tax Cheng Co Group

A Look At The American Families Plan Center For Agricultural Law And Taxation

Comments

Post a Comment